Don’t run out of money

Of all the financial challenges and concerns that we face over our lifetimes, avoiding running out of money in retirement probably sits at the top of the list. No-one wants to end up relying on meagre state benefits and eating own-brand baked beans every day. Retirement Rule 1 is crucial but not guaranteed. As Warren Buffett might say, Retirement Rule 2 is not to forget Retirement Rule 1!

In the good old days, retirees could rely on defined benefit pensions and/or annuities to provide lifelong retirement income. Today, many retirees rely, to a varying degree, on taking money from accumulated pension pots for their retirement income. That makes outcomes less certain and decisions far tougher.

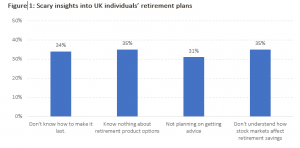

From time-to-time scary data surface about the state of retirement planning in the UK. Recently, LV – the insurance company – published the results of a survey of 4,000 people relating to how they intend or are handling their pension arrangements[1]. LV estimate that there are around 30 million pension holders in the UK. The results are a little startling, to say the least. Take a look at the chart below.

As one third (or effectively 10 million people) do not know how to make their retirement pot last, it implies that two thirds apparently do know. Perhaps these are the two thirds who plan on taking advice! Not running out of money is a complex problem that taxes even the best financial brains. It would seem that many people may be overconfident in their assessment of how much they truly know about retirement planning.

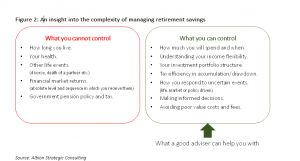

The figure below provides an overview of just how tricky this process is and how it must be an ongoing, dynamic process, not a one-off decision at retirement. Knowing what you cannot control and understanding what you can, provides some insight into the complexity of – and solutions to – retirement planning.

Retirement is meant to be a time of financial freedom allowing you to do the things you want to do, when you want to do them and who you want to do them with. It is a great shame that many people in the UK will fail to achieve even a modicum of financial freedom and lifestyle choice. As a broad rule of thumb, today, £1 million will buy an inflation-linked annuity income of around £27,500 a year[1]. Yet the median UK pension pot is around £91,000[2] (for those 55-64 years old), which on the same basis will deliver only £2,500 a year.

Taking an income from an investment portfolio may allow a withdrawal rate that is potentially a little higher but needs a lot of care and attention to reduce the risk of running out of money. Making sure that you optimise the decisions that need to be made – and control all the things you can control – will allow you to maximise the stability, level and longevity of retirement income you need.

That is what a good adviser will help their clients do and where they earn their fees. The best way to achieve Retirement Rule 1 is to take proper financial planning advice.

If you have any questions, thoughts or actions relating to the content of this article please get in touch with us by calling us on 028 9099 6948 or by emailing info@pacem-advisory.com

[1] https://www.scottishwidows.co.uk/retirement/retirement-explained/taking/pension-options/guaranteed-income/index-linked-annuity/

[2] Office for National Statistics. https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/datasets/pensionwealthwealthingreatbritain

[1] 10m pensioners risk running out of money, FT.com 26th August 2021