At the start of 2022 investors needed reminding that investing is not an easy game, despite having enjoyed around a decade of relatively strong – and fairly consistent – market returns, even in light of a global pandemic, recession, and political polarisation. 2022 has laid bare the fact that investing can very much be a game of ‘three steps forward, one step back’. If there was no risk of market downside, it would be unreasonable to expect any return at all above cash. This short note provides a brief look at the past 12 months, and highlights some of the lessons we can learn as investors.

Looking backwards

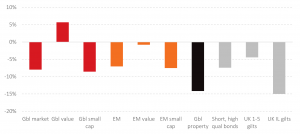

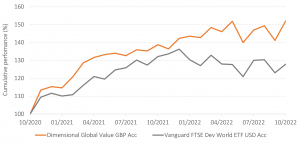

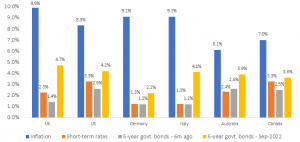

For many investors 2022 was a relatively tough year, with returns ranging from benign to poor across most major asset classes – global developed value companies being an exception. Rising prices make returns significantly worse on an after-inflation basis, with year-on-year inflation in the UK having reached levels not seen for decades. The year was particularly challenging for investors in bonds, as yields have risen (and thus prices have fallen) across much of the world. Bondholders with longer and lower quality debt suffered greater capital falls – shorter dated, high-quality bonds continue to be preferred.

Figure 1: Global investment returns – sensible assets 2022 returns

Data: Funds used to represent asset classes, in GBP. See endnote for details.

With few places to hide most investors will have finished the year in negative territory, which is to be expected from time to time. The magnitude of the losses, however, should lie well within the tolerances of their financial plan. Investors with a reasonable amount of equity exposure should be able to withstand more material falls than those experienced in 2022 (global equities fell by over 40% during the Credit Crisis, for example). That said, those overweighting value companies and focusing on shorter-dated bonds will find themselves in better space than most, though this is little consolation when returns are still negative in an absolute sense. Investing is never a straight-line journey.

Sensible, systematic portfolios comprising a diversified basket of equities – with tilts to value and smaller companies – paired with short dated high-quality bonds – from low risk to high risk – will have provided better results than most other solutions in 2022. Such solutions outperformed over 70%[1] of professionally managed multi-asset funds over the 12 months due to these portfolio decisions.

Investors with portfolios denominated in GBP have benefited from the strong performance of the US dollar, which has meant overseas assets translate back to more in GBP terms. In USD terms (which is often reported in the press) global equities fell around 18% in 2022, around 10% more than when viewed in GBP terms. Some of the major US firms like Tesla and Meta which have hit headlines with share price falls of over 70% and 60% respectively in the past year, however, they only represent a small allocation – and thus have a small impact – in a well-diversified portfolio.

The asset class that – uncharacteristically – stole the headlines (for all the wrong reasons) was fixed income. Many bond indices experienced their worst calendar year on record. This was chiefly due to a swift increase in the compensation bondholders demand for lending their capital, on the back of – more persistent than foreseen – high inflation and corresponding rising policy rates from central banks. Rising borrowing costs, and little yield buffer to begin with, have meant absolute falls for fixed income investors, something that few investors will have seen, in a year when equities fell too. The last time was 1994.

The reality is, however, that higher yields are a good thing for investors with time horizons longer than the maturity of their bonds. Over time, the new bonds being invested in have been at a higher yield, providing a larger yield cushion going forward and reducing the chance of absolute falls on an interim basis. Bondholders start 2023 in far better shape – from an expected return perspective – than 12 months prior. Today, 5-year gilt yields stand at 3.5%, as opposed to -0.1% at the start of 2022.

Looking forwards

Uncertainty abounds – it always does. Basing investment decisions on forecasts or judgments is generally best avoided. Forming market outlooks can be used to create accountability, or perhaps at best just for a bit of fun. After stating his column’s 2023 predictions Robert Armstrong, of the Financial Times, questions: ‘Do I have high confidence in any of this? Heck no.’. There is no shortage of seemingly sensible predictions on market performance and global developments[2], nor any effective method to separate those that will be more or less accurate.

Investors should therefore look to the future with the anticipation that new information will come to light, and markets will react quickly to take it into account. Without the ability to profit directly from superior information one, therefore, should construct a diversified portfolio built to weather all storms, guided by an ever-growing body of academic literature. If, for example, inflation or growth come in higher or lower than expected, some parts of the portfolio will – by design – be helping, and others detracting from, performance. That is what diversification is!

With the reasonable belief that risk and reward go hand in hand, each day it should be expected that incremental risk taking in a portfolio will be rewarded, such as owning equities or bonds over cash. However, on a daily (or even multi-year) basis – which in the context of a true investment time horizon is miniscule – the expected daily reward is dominated by unexpected noise, which can be positive or negative.

And finally…

This note has focused on investing. Outside of investors’ portfolios, Putin continues wage his illegal war in Ukraine and much of the world is feeling the repercussions of the supply chain impacts. The NHS is under considerable strain. Increasing borrowing costs and a higher cost of living place pressure on many of us. These challenges provide a stark reminder that we should be grateful for what we can be. News outlets have a bias towards reporting bad news, which is hardly surprising. Bad news sells.

Nicholas Kristof of the New York Times plainly states that journalists ‘report on planes that crash, not planes that land’ and writes[3] a column on some significant achievements made by the human race in 2022. For example, solar power is now on track to overtake coal as the world’s leading power source in the next five years. Time away from day-to-day news can help one feel more positive or reading information from news outlets such as Good News Network®[4] can be a refreshing exercise. Enjoy a fulfilled 2023 and all the better news it may bring.

From an investing perspective, we are hopeful for the best in 2023 and beyond but remain prepared for the worst.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Data series used

| Asset class | Fund | ISIN | Weight in P60 |

| Gbl market | Fidelity Index World P Acc | GB00BJS8SJ34 | 27.5% |

| Gbl value | Dimensional Global Value GBP Acc | IE00B3NVPH21 | 9.2% |

| Gbl small cap | Vanguard Glb Small-Cp Idx £ Acc | IE00B3X1NT05 | 9.2% |

| EM | iShares Emerging Mkts Eq Idx (UK) D Acc | GB00B84DY642 | 4.9% |

| EM value | Dimensional Emerging Mkts Val GBP Acc | IE00B0HCGX34 | 1.6% |

| EM small cap | iShares MSCI EM Small Cap ETF USD Dist | IE00B3F81G20 | 1.6% |

| Gbl property | L&G Global Real Estate Div Index I Acc | GB00BYW7CN38 | 6.0% |

| Short, high qual bonds | Dimensional Global Short Dated Bd Acc | GB0033772848 | 36.0% |

| UK 1-5 gilts | iShares UK Gilts 0-5yr ETF GBP Dist | IE00B4WXJK79 | 0.0% |

| UK IL gilts | Dimensional £InflLnkdIntermDurFI GBP Acc | IE00B3PVQJ91 | 4.0% |

Weights for each portfolio are pro-rated up/down according to portfolio equity allocation. Fixed income funds in blue, equity funds in green. More information is available on request.

[1] Source: Albion Strategic Consulting. Systematic portfolios breakdown found in endnotes.

[2] Armstrong provides a list of outlooks from several significant market participants: https://www.ft.com/content/7803704f-8161-4af8-b9b5-1a7ccd5c2cba

[3] https://www.nytimes.com/2022/12/31/opinion/2022-good-news.html

[4] https://www.goodnewsnetwork.org/

Recent Comments