Market volatility can be uncomfortable—but it’s not unusual. In fact, it’s a feature of investing, not a flaw.

Donald Trump has shocked the global markets over the past week since his Liberation Day tariff announcement. At the time of writing, the global stock market has fallen over 5% from the start of 2025, with the S&P500 down over 8% over the same time period.

However, the market decline of 3rd & 4th April is only the 39th largest drop since 1st January 2000.

During times of uncertainty, remaining invested in a globally diversified, suitable portfolio is not just prudent—it’s essential for long-term financial success.

Timing the Market is Risky—and Rarely Successful

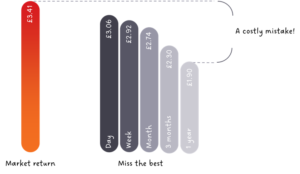

Attempting to move in and out of markets to avoid downturns may seem appealing, but missing just a few of the best-performing days can significantly erode your returns. The cost of mistiming the market far outweighs the perceived benefit of “playing it safe.”

Casting our minds back to the Covid-19 pandemic the US stock market dropped 34 % in just 23 days — faster than ever before. Yet within a year, the market had not only recovered but also risen 78% from its lowest point. People who sold during the panic missed one of the strongest recoveries ever.

Volatility Happens Every Year

Every single year, global markets experience drawdowns—temporary declines from peak levels. These drops are normal. Intra-year declines are part of investing, yet more often than not markets tend to end the year in positive territory.

This volatility is expected and already considered in the assumptions behind your plan.

Patience is a Proven Strategy

History has consistently rewarded investors who stay calm, remain disciplined, and stick to their long-term strategy.

The chart below shows the growth in world equity markets despite the never-ending stream of negative world events – The Wall of Worry

Reacting emotionally to short-term noise can lead to poor outcomes—while staying the course is the key to wealth preservation and growth.

Your Financial Plan Already Accounts for Market Drops

We have built your financial plan with these events in mind. Our assumptions used in your plan factors in the reality of market downturns.

As part of our planning for those who require income in retirement, we include Defensive Assets – Government Bonds. This helps to protect capital value of this income, typically 5-7 years worth of income. This prevents the need to sell during a market downturn.

As always, we are here to support you, answer questions, and ensure your plan remains aligned with your goals—no matter what the markets are doing.