Five Key Probabilities for Investment Success

In life we make probability-driven choices all the time (can I cross the road safely, despite that approaching car? etc.). By-and-large, we weigh up the uncertainty involved, the upside on offer and then dive right in. Not all our decisions are optimal. Did we understand the risks fully? Did we know what the up and downside consequences were and, importantly, the likelihood of them happening?

When it comes to investing, we face similar challenges, but fortunately we have a wealth of market data and evidence to help us make better informed decisions around where the probability of success lies. To avoid the serious consequences of getting it wrong, e.g. building too small a pot to retire comfortably on, or running out of money in retirement, there are five key probability-based choices to focus on.

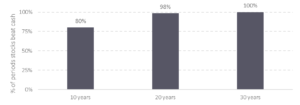

Key Probability 1: Stocks are likely to beat cash over most 20-year horizons

Using a long-run global stock market data set, the evidence suggests that over 98% of the time, stocks beat cash over a 20-year timeframe. Most investors have investment horizons of at least that. Over the period Feb-55 to Sep-24 stocks delivered around 5.6% above inflation against 1.2% for cash. There are no guarantees, but the odds are stacked in your favour.

Figure 1: Stocks are likely to beat cash over time

Source: Albion World Stock Market Index versus UK One Month Treasury Bills

Conclusion: Make sure you invest. For most long-term investors a substantial holding in stocks makes good sense. What that level is will depend on your personal circumstances.

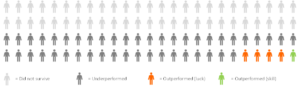

Key Probability 2: Owning the market, over trying to be too clever, is likely to pay off

Investment theory suggests that markets work well at incorporating information into securities prices. In other words, there are few £20 notes lying around on the investment pavement to be scooped up by professional fund managers and other investors, to allow them to beat the market. Empirical data show that very few professionally managed funds beat the market, and even fewer with any proven degree of skill.

Figure 2: Only 5% of global equity funds beat the market over 20 years

Source: Albion GAMETM 24.5 – global equity funds to June 2024.

Conclusion: Holding the market and capturing the returns on offer should be your overriding priority, rather than trying to pick fund managers who claim to be able to beat the market. Even if they appear to have track records suggesting they can, are they just lucky or skilled? You need decades of results to work out which. Play the odds overwhelmingly in your favour.

Key Probability 3: Diversification is likely to deliver a better outcome than concentration

Research shows that the entire wealth created in the US equity market since 1926 has been driven by just 4% of companies. The story is similar for global markets. As evidenced above, few professional fund managers can spot these companies in advance. Holding a concentrated portfolio of ‘guesses’ is less likely to lead to a worse outcome than the broad market. In general, diversification helps to smooth the returns of a portfolio as some investments zig while others zag. Some concentrated portfolios may get lucky, but that’s a gamble.

Figure 3: US 1926-2015 – only a handful of companies created all the wealth

Source: Bessembinder, H. (2018). Do stocks outperform Treasury bills? Journal of Financial Economics, 129(3), 440–457. https://doi.org/10.1016/J.JFINECO.2018.06.004

Conclusion: This suggests that being well-diversified is likely to play out in your favour. It ensures that the wealth creators of the future will be held in your portfolio. You might get lucky with a concentrated portfolio, but the odds are not in your favour.

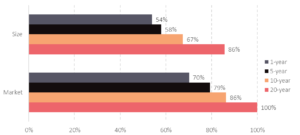

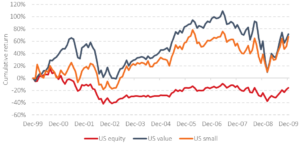

Key Probability 4: Holding sensible exposures to well-researched risk factors should pay off

Not all equities have the same risk. Behemoths, such as Microsoft and Apple, are very different to smaller companies. Rapidly growing companies are very different to stocks that are less financially healthy. The market prices these shares accordingly. The historical evidence suggests that, on a relative basis, companies that are smaller and/or less financially healthy, are cheaper than larger companies and rapidly growing companies. They are cheaper for a reason – they are riskier. The flip side of the coin is that this higher risk is expected to deliver higher returns over time.

Figure 4: The chances of capturing excess returns improves over time

Source: Ken French Data Library – US three factor model[1]

Conclusion: For investors with longer horizons, taking on these additional risks has a higher expected chance of paying off. Incremental returns compounded over time could make a material difference to outcomes.

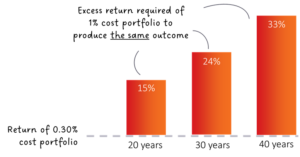

Key Probability 5: Reducing costs is likely to deliver higher returns

As a general theme, lower costs of investing are better than higher costs. As an example, take two global equity funds that before costs deliver a return of 5% per annum. Fund A has an ‘all-in’ cost of 1% and Fund B 0.30%. Over 30 years the investor in Fund B will accumulate 24% more wealth than the investor in Fund A.

Figure 5: Lower costs improve the chances of better outcomes.

Source: Albion Strategic Consulting. Professor William Sharpe’s Terminal Wealth Ratio.

Conclusion: Keep a keen eye on costs. The cost-to-outcome relationship is real and important in investing. Lower cost solutions will, in all likelihood, improve your chances of a good investment outcome, all other things equal.

In all likelihood…

Investors who play the probabilities in their favour deserve – and are likely to experience -better investment outcomes than those who fail to do so. Do not gamble on your future.

Important Notes

This is a purely educational document to discuss some general investment related issues. It does not in any way constitute investment advice or arranging investments. It is for information purposes only; any information contained within them is the opinion of the authors, which can change without notice. Past financial performance is no guarantee of future results.

Products Referred to in this Document

Where specific products are referred to in this document, it is solely to provide educational insight into the topic being discussed. Any analysis undertaken does not represent due diligence on or recommendation of any product under any circumstances and should not be construed as such.

[1]https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/Data_Library/f-f_factors.html

Recent Comments